How To Buy a Car With Bad Credit

Introduction

Low credit is generally defined as a score under 629. You can have low credit for a variety of reasons, including a history of making late payments to lenders, identity theft or simply not having enough years of credit history. Your credit score dictates what type of interest you’ll end up paying on your car loan, and a low score means a higher interest rate.

The good news is you aren’t necessarily destined to pay a high interest rate on your auto loan for five or more years just because your credit score isn’t good. This guide will help you figure out how your credit score affects your auto loan along with your options for getting an auto loan with affordable payments if you have bad credit.

Bad Credit Auto Loans Made Fast & Easy . Get Approved TODAY!

The good news is you aren’t necessarily destined to pay a high interest rate on your auto loan for five or more years just because your credit score isn’t good. This guide will help you figure out how your credit score affects your auto loan along with your options for getting an auto loan with affordable payments if you have bad credit.

Who this guide is for:

I’ve prepared this guide with the following groups of people in mind:

- Young adults who have a short history of credit and a low credit score

- Immigrants who have not established a long credit history and need a vehicle

- Anyone with less than great credit

- Anyone who is in the market for a new vehicle

Methodology

To find out what options are available for consumers with bad credit who need to buy a car, I talked to nationally-recognized credit expert John Ulzheimer, who has over 24 years of experience in the consumer credit industry, and Beverly Harzog, consumer credit expert and author of The Debt Escape Plan. In addition, I read 14 publications about credit scoring and securing auto loans. These sources provided me with insight into how credit scoring works, how it can negatively impact your ability to get a low interest rate and what you can do to keep yourself from getting even further into debt when you have to buy a car with bad credit.

What is a credit score?

Before we start talking about how to buy a car with bad credit, let’s talk about what a credit score is. Your credit score is a three digit number that is calculated based on your credit history. While there are several credit scoring calculators out there, the one that controls the market, and therefore the only one you really need to worry about, is your FICO credit score. The FICO credit score scale ranges from 300-850.

According to Ulzheimer, any score under 540 is at risk of being denied an auto loan of any kind, and a score of 740 or higher is likely to get the best interest rate, although your results may vary based on what is in your credit score and who you are working with as a lender.

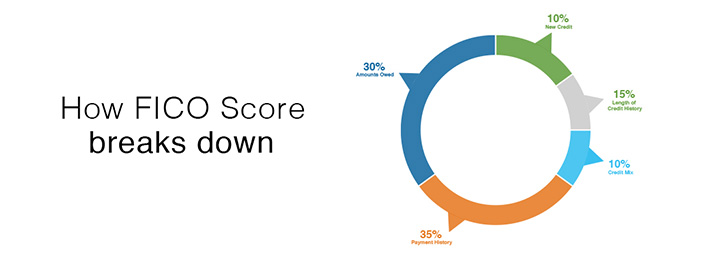

What is counted in your credit score?

Your credit score is based on your credit history, which includes credit cards, student loans, auto loans and mortgages. In addition to the type(s) of credit you have, your FICO score also calculates your payment history including late payments, how long you have had accounts open, how often you use your accounts and how many new credit lines you have open.

Because every individual’s credit history is different, certain factors will hold more weight than others. For instance, if you do not have a long credit history and have several late payments, your credit score will be factored differently than someone with a long credit history and the same amount of late payments.

Even though every score is factored based on the individual’s personal credit history, FICO maintains a particular breakdown for calculating credit scores:

Payment history (35 percent)

Your payment history makes up the biggest percentage of your FICO score, which can be good or bad news depending on how often you pay your bills on time. If you are a frequent late-payer, now is a great time to start getting those payments in on time. The good news is that because payment history makes up such a large portion of your overall score, it can be relatively easy to bump up your credit score if you just start making payments on time. Payments that have gone into collections and judgements are counted here.

Amounts owed (30 percent)

There are a few things FICO considers in this category. First, what is the overall amount of money you owe on all of your accounts? Keep in mind that even if you pay off multiple credit cards every month, your FICO score may reflect a balance depending on what your lender has reported to the credit bureau. Generally the balance of your last statement is what is used when you pull up your credit score. Your FICO score will also consider what you owe on specific accounts such as credit cards and loans.

In addition to how much total money you owe, your score will calculate how close you are to reaching your credit limit. Individuals who are close to maxing out their credit limit are a higher risk for lenders than those who are not. Having a high percentage of accounts with balances also makes you a high risk for lenders.

Finally, your score considers how much you still owe of the installment on a loan. Paying down your installment is a good sign to lenders that you can manage your debt.

Length of credit history (15 percent)

Your FICO score takes a look at how long you have had open accounts, how often you use those accounts and the average age of all of your accounts. It is still possible to have good credit even if your accounts are new, based on the other factors in your FICO score.

Credit mix in use (10 percent)

Your FICO score will be higher if you can demonstrate an ability to manage different types of credit lines such as a car loan, mortgage and credit cards.

New credit (10 percent)

Opening several new lines of credit in a short amount of time is a red flag for lenders, especially if you have a short credit history.

While this is the general breakdown of your FICO credit score, keep in mind that your score will be weighted differently depending on your particular credit history. If you only have one credit account, for instance, your score will look different than if you have multiple credit cards and a mortgage.

How bad credit affects your car loan

In general, a credit score that is 740 or higher will get you the best interest rate on an auto loan. If you have great credit, you might be able to score an auto loan as low as zero percent (yes, you read that right). If you have terrible credit (lower than 580), you might be looking at interest rates as high as 20 percent or even close to 30 percent. That can add up to paying thousands of dollars extra for an automobile with bad credit versus good credit.

Lenders want to feel confident that borrowers will pay their money back on time and in full, which is why consumers with good to great credit get the best interest rates. They pose a low enough risk based on their credit history that lenders feel assured they will pay their debt back responsibly.

Consumers with bad credit, on the other hand, pose a high risk. Things like missing payments, defaulting on loans and having a high debt-to-income ratio all raise red flags for lenders, who will charge a high interest rate when they do not feel confident they will get back the money they are lending.

In addition to reviewing your credit score, lenders will also take a look at other factors that are not included in your FICO report such as :

- Your income

- What type of loan you are trying to get

- Your work history

- How long you have worked at your current job

How to shop for an auto loan when you have a low credit score

Where you can get auto loans

Anyone shopping for a car should also shop around for a lender. It’s a misconception that you have to settle for the first financing offer you receive, and, in fact, you shouldn’t consult with only one lender any time you need to take out financing for a purchase. You can get an auto loan from several sources including:

- Banks

- Credit unions

- Dealer Financial Services Group (DFSG)

- Car dealership

- Finance companies

7 steps to take to get an auto loan

Regardless of the reason for it, having a low credit score can make it difficult to buy a car. In general, car dealerships raise interest rates for buyers with low credit scores, also called subprime buyers, because subprime buyers pose a greater risk than buyers who have great credit. However, even when you have bad credit, it’s important to reach out to a reputable bank or lender to see what options are available for financing your auto loan instead of automatically accepting a high interest rate. Follow these steps to secure a fair loan:

1. Ask yourself how badly you need a car

Are you buying a car because you really don’t have any other mode of transportation? Or is your car more of a luxury item? Both Ulzheimer and Harzog recommend only buying a car with bad credit if you are in an emergency situation.

Before you start shopping for a car and an auto loan, take a closer look at your situation to see if you have another option such as using your current car, carpooling or using public transportation for 6 months to a year while you work on rebuilding your credit.

“If getting a car isn't an emergency, I suggest getting a secured card and spending at least six months (a year is better, though) responsibly using the card,” says Harzog.

A secured card is one way to build credit when you don’t have a credit history, and it can also be used to rebuild credit. You make a deposit in the bank when you open your secured card to secure the card, and you get that deposit back when you close your account.

“When you're using a secured card, you're actually using credit,” Harzog explains. “As long as the card issuer reports your payment history to the three major credit bureaus, you'll begin to rebuild your credit history and bring up your FICO score.”

However, “if you have bad credit because you misused credit cards, this is not a good idea. Don't use credit cards again until you feel comfortable you can control your spending.”

If you must get a car and have bad credit, then prepare yourself for a high-interest loan. If you have high credit because of your payment history (which makes up 35 percent of your credit score), then start paying your bills on time. Even a few months of paying bills on time can bump up your credit score. If you can push buying a car off for even a month or two, you might end up with a high enough credit score to make a difference when it comes to interest rates.

2. Check your credit report

Don’t take a dealership’s claim that you have bad credit at face value. You are allowed to perform a free credit report check once every twelve months. See for yourself what your score is, what activity has affected your score and if there is any suspicious activity on your report. Bring your credit report with you when you meet with potential lenders so that you are on the same page when you discuss your financing. Harzog suggests talking to your lender about your credit history “if you have a good reason for a negative item” to see if that affects your interest rate. Some lenders may be willing to work with you depending on the reason for your low credit score.

3. Shop around

“Don’t think that just because you have bad credit you can’t get a car loan,” says Ulzheimer. In addition, “don’t just assume that your credit is bad.” Your definition of bad credit might not be the same as your lender’s definition, and different lenders will offer different rates. Do your research by finding out the rates various lenders charge so you don’t get taken advantage of.

Ulzheimer recommends looking up a lender’s auto lending rate sheet to learn what the current rates are for new and used vehicles based on your credit score and bringing this information with you when you meet with a lender.

4. Limit your search to a 2 week timeframe

It’s a cruel irony that applying for loans means lenders will check your credit score, and each check of your credit report negatively impacts your credit score. The good news is that scoring models usually count every credit inquiry performed by an auto loan lender within a 2 week time frame as just one inquiry. Because of this, it’s important to only apply for auto loans when you are actually ready to take one out. Otherwise you risk making your credit score problem worse.

5. Opt for a shorter loan period

You might have lower monthly payments with a five-year versus a three-year loan, but pay attention to the interest rate. Generally interest rates are lower for shorter term loans, meaning you will end up paying less for your car overall. Plus, you’ll end up with a few extra years in which you won’t need to make car payments so you can focus on paying off other loans to raise your credit score.

6. Look for newer versus older vehicles

Common sense might tell you an older vehicle will cost less, but the truth is older vehicles tend to charge higher interest rates than newer ones. Ulzheimer recommends anyone looking to finance a vehicle look at new cars first, and then newer used cars since these are the cars that tend to offer the best financing.

However, it’s possible to find a better deal on an older used vehicle, so check out all of your options before deciding. You may end up finding an older vehicle you can afford to buy with cash, which would eliminate your need to get financing in the first place.

7. Consider getting a cosigner

Depending on your situation, getting a cosigner for your car loan might be your best option to get a loan at a reasonable interest rate. Consider looking for a cosigner if any of the following apply to you:

- Your income is lower than the minimum requirement for an auto loan

- You have bad credit

- Your debt-to-income ratio is too high to qualify for a loan

- You have a variable income

Asking someone to cosign on an auto loan is a big deal, and Ulzheimer strongly discourages anyone from agreeing to be a cosigner. Your cosigner will be responsible for making your payments in the event you are unable to fulfill your loan obligations, so only take this approach if you are confident you will be able to make your payments in full and on time. Provided you are able to make your payments, having a cosigner on your loan can help boost your credit score.

What not to do when shopping for an auto loan

Shop at a “buy here pay here” lot

You might have heard commercials from local car dealerships targeting subprime buyers, but be wary. Those “buy here pay here” dealerships will generally charge more money for cars than they are worth. “Buying a car from one of these lots won’t necessarily hurt your credit score, but it won’t help it either,” says Ulzheimer. That’s because these lots don’t have to report to the credit reporting agencies, meaning your credit score will remain the same even if you make all of your loan payments on time and in full.

Let yourself get schmoozed by verbal promises

It’s easy to believe a salesman, particularly when they’re telling you things you want to hear about your car loan. Don’t believe your car salesman or F&I officer based solely on verbal promises. Make sure everything is in writing before you agree to terms.

Go car shopping without checking out your options

A lot of consumers are misinformed about what their credit score is and what options they have for financing based on it. Do some research before you go car shopping to see what rates you are eligible for. If you are clearly uninformed, you could wind up signing on to an interest rate that is way higher than what you are eligible for. In addition, avoid talking about yourself as high-risk: the more desperate you appear, the more likely you are to have interest points tacked on unnecessarily, which just translates to money in your salesman’s pocket.

Spring for extras

When you’re already tight on cash, you don’t need to pay for extras that aren’t necessarily worth the money in the first place. Things like extended warranties, GAP insurance and credit life policies are all optional (regardless of what your F&I officer tells you) and could end up costing up to thousands of additional dollars over the lifetime of your loan.

Sign anything without reading and understanding it thoroughly

I know you just want to get out of the dealership and on the road, but if you remember only one thing from this article, let it be to read everything carefully before you sign and walk away. Neglecting this could end up costing you thousands of dollars and/or making your credit even worse depending on what is included in your contract. Ask questions if you don’t understand, and don’t be afraid to walk away and tell the F&I office that you need some time to think it over before you sign. They’ll want your business when you’re ready to give it to them, no matter how much of a fuss they make at the thought of you leaving.

Things to look for include: penalties for prepayment, a loan with pre-calculated interest and who the primary buyer is when you are getting a cosigner.

Leave the dealership before you finalize your financing

This is a cruel trick played on eager consumers who just want a vehicle that can drive. Some dealerships will offer you financing “based on final approval,” and will let you drive off the lot before your financing is actually finalized. You, the unsuspecting consumer, are later told that your original financing wasn’t approved and are then slapped with a significantly higher finance rate. Don’t fall for this. Leave the lot in your old clunker, take the bus, walk home or catch a ride with a friend instead of driving off the lot in a car without approved financing.

What to do if you end up buying an auto loan with a high interest rate

Refinance

“A lot of people don’t realize they can refinance their auto loans,” says Ulzheimer. “They think of refinancing for house loans and student loans, but they don’t know that they can get a better rate on their auto loan by refinancing when their credit score gets better.”

If you absolutely need a car and you end up with a punitive interest rate, keep in mind that you can refinance in 12 months, or whenever your credit score goes back up. Talk to your lender to find out what your options are. You don’t need to pay 30 percent interest for five years if your credit score improves and allows you to get better financing.

Pay more than the minimum payment, and pay on time

Another way to reduce the time period of your loan is to pay more than the minimum payment each month to reduce the amount of overall payments that you make. If you can’t pay more than the minimum, at least make sure that you make your payments on time since, even at a high interest rate, an auto loan will still help your FICO score.

An auto loan is “an installment loan and it contributes to the ‘mix of credit,’ which is a factor in your FICO score,” according to Harzog. However, “it's only 10 percent of your score so don't expect to get a big bump in your score.”

Conclusion

Whether you have no credit history or you have made some mistakes in the past, having a bad credit score can make it difficult to shop for a car loan. However, many banks offer auto loans to people with bad credit. Start by asking your local bank or credit union where you keep your checking and/or savings account to see if they can help you with an auto loan. Larger national banks can also help you secure an auto loan if you have bad credit.

In general, it is better to go with a bank or an auto financing lender rather than the car dealership down the street that is offering a “buy here, pay here” deal. If you do wind up with a high interest rate on your car, work on rebuilding your credit score so that you can eventually refinance. As Harzog says, “When you have good credit, you often have good options.”

Comments

Post a Comment